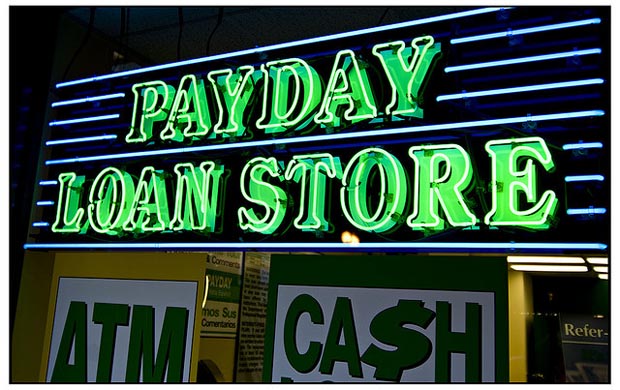

Get Instantaneous Authorization for Straight Cash Advance Online - Quick Money in Minutes

Direct cash advance lendings supply a practical solution for those seeking immediate monetary help. These loans can provide a short-term economic pillow, yet it's essential to evaluate the disadvantages and pros meticulously.

Advantages of Straight Payday Advance

Straight payday finances offer a effective and convenient option for those looking for quick accessibility to funds in times of financial urgency. Conventional lendings frequently involve lengthy application processes and waiting durations, whereas straight cash advance car loans normally give immediate approval, with funds paid out in an issue of hours.

Additionally, direct payday advance come to individuals with differing credit rating. While conventional lending institutions may require a high credit scores rating for funding approval, payday financing companies are more lenient in their eligibility criteria. This inclusivity allows individuals with limited or inadequate credit report to protect the funds they need. In addition, the online application procedure for direct payday loans is basic and streamlined, eliminating the requirement for comprehensive paperwork and assisting in fast authorization. Overall, the advantages of direct payday fundings make them a sensible option for individuals looking for instant economic help.

Online Application Refine

Launch the procedure by accessing the online system to begin your application for a payday advance. The online application procedure for a straight payday advance loan is created to be uncomplicated and easy, enabling you to finish it in simply a few minutes. Start by giving basic personal details such as your name, address, get in touch with details, and work condition. You may also need to submit details regarding your revenue and financial information. Ensure to confirm all the details you give to make sure precision and stay clear of hold-ups in the approval process.

The loan provider will after that analyze your application and figure out if you certify for a payday lending based on their criteria. The on the internet application process removes the need for in-person visits to a physical place, making it hassle-free and effective for those in requirement of fast monetary aid.

Instant Authorization Requirements

Having actually successfully finished the online application procedure for a straight cash advance finance, the next vital action includes satisfying the immediate authorization criteria stated by the lender. Instantaneous approval standards commonly include fundamental requirements such as going to least 18 years old, having a constant income, and possessing an energetic bank account. Lenders may likewise consider aspects like the applicant's credit rating, employment standing, and the amount of the requested lending.

It is important to give current and accurate details during the application process to boost the chances of immediate authorization. Lenders depend on this details to examine the candidate's ability to pay back the finance immediately. Satisfying the immediate approval criteria immediately can cause fast accessibility to the funds required, often within mins of authorization.

Furthermore, preserving a good credit rating and a steady economic standing can better enhance the possibility of immediate authorization for future funding applications. By satisfying the instant authorization standards regularly, customers can establish a favorable relationship with the loan provider and access fast cash whenever required.

Quick Money Disbursement

Upon meeting the immediate approval requirements for a straight cash advance finance online, the next critical step includes the effective dispensation of quick money to the authorized applicant. As soon as the finance application is accepted, the loan provider initiates the process of paying out the funds promptly. In the majority of instances, direct cash advance lending institutions strive to provide quick cash money dispensation, commonly within the exact same day and even within minutes of approval.

To ensure fast money dispensation, candidates are typically required to give precise financial information for digital transfer of funds. Payday Direct Loans Online. This makes it possible for the lending institution to promptly transfer the approved loan amount straight right into the debtor's bank account. Additionally, some lenders might offer the choice of obtaining cash through different approaches such as pre paid debit cards or in-person cash money Your Domain Name pick-up at marked places

Repayment Options and Terms

Reliable administration of repayment choices and terms is critical for consumers of straight payday advance to fulfill their economic Find Out More obligations sensibly. When taking into consideration settlement choices, debtors ought to very carefully examine the terms provided by the loan provider. Direct payday advance commonly need payment completely on the borrower's next cash advance, which is an essential aspect to think about when intending funds. Some lending institutions may use the adaptability of extending the settlement duration, yet this frequently incurs additional charges. It is essential for consumers to understand the terms and conditions of the lending contract to prevent any type of possible misunderstandings or financial pressure.

To guarantee smooth payment, consumers should produce a budget plan that includes the financing payment amount. By remaining arranged and positive in managing settlement alternatives and terms, debtors can meet their financial responsibilities without delay and preserve a positive financial standing.

Verdict

Finally, direct payday advance use benefits such as quick money disbursement, on the internet application procedure, and flexible repayment choices (payday loans near me). Meeting the instantaneous approval criteria guarantees a smooth and effective loaning experience. It is very important to understand the conditions and terms associated with these finances to make informed monetary choices

:max_bytes(150000):strip_icc()/Personal-loans-111715-final-3c39d6d214e44604bdc1efca2525d37d.png)

:max_bytes(150000):strip_icc()/6-benefits-of-using-a-credit-union.aspx_final-6e501699186e429ab6458d9e36ebe4a1.jpg)